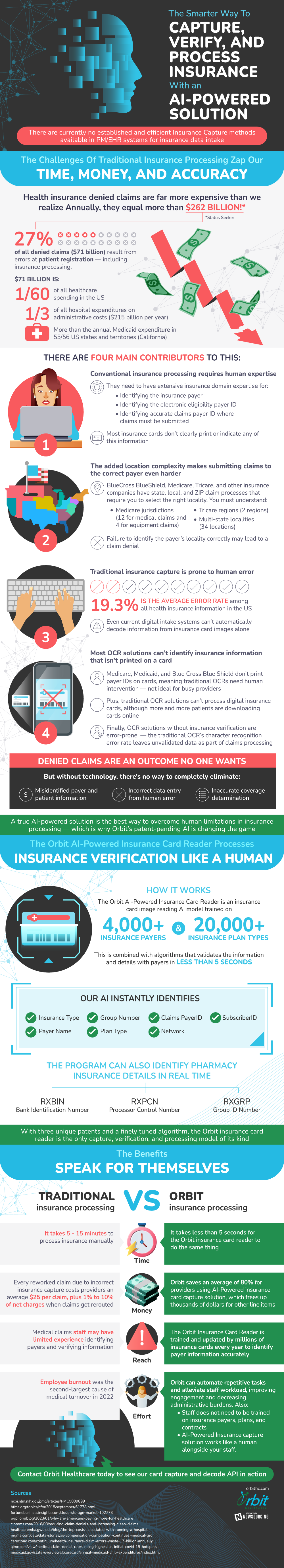

In the digital age, there is a growing need for a smarter way to capture, verify, and process insurance. The methods in place today are holding the industry back, hindering operations and costing companies billions annually. Denied claims and avoidable errors steal our time and money, showing the true necessity of developing these processes.

The main contributors to the drawbacks of insurance processing are due to the limitations of the solutions in place. Most of the technology currently in use cannot identify insurance information that is not physically on an insurance card. In addition, some of the most popular insurance providers do not even print payer IDs on cards, making this not ideal for busy providers. Finally, in a time when so many are used to digital means of doing business, most patients are only downloading their cards online. Because of these limitations, humans are needed to intervene to complete the job. Not only does this require highly trained individuals, but even when those processing information are knowledgeable, errors are still highly likely. The current error rate in the health insurance sector of the industry is over 19%, showing just how detrimental these errors can be.

Denied claims are not only costly, but they are common, as misidentification, incorrect entry, and just simple inaccuracies can lead to them. Luckily, there are modern solutions in early development, meaning that efficiency is on the horizon. A true AI-powered solution has been identified as the best way to overcome these human limitations in insurance processing. This in combination with unique algorithms has the power to identify thousands of payers and tens of thousands of insurance plan types. AI models can be trained to instantly identify several different metrics, and in real time. What traditional methods could once do in minutes, artificial intelligence can complete in seconds.

These developments have the power to change the game for insurance plan holders and providers. They can save money, time, and even improve the lives of the humans that work in the industry. They can take the place of the most tedious human tasks, making insurance processing an all around better experience for all involved.

The insurance industry is one that has a role in nearly every aspect of our society and economy. It is fueled by the very people who benefit from it, and therefore must keep up with ever changing times and ways of life. Artificial intelligence has the power to make these changes possible, and to allow us to remain up to speed with the wants and needs of the modern consumer.

Source: OrbitHC